- #Quicken 2015 for mac vs ibank for free#

- #Quicken 2015 for mac vs ibank how to#

- #Quicken 2015 for mac vs ibank software#

You can get started with Personal Capital for free to see for yourself. If you’re looking for an alternative to MS Money on Mac that not only helps you manage finances but optimize them too, Personal Capital is an excellent free replacement. There is however an official Personal Capital iOS app which looks great on both iPhone and iPads and gives you most of the same features as the desktop version. Other useful features we really like about Personal Capital include automatic bill reminders, stock value updates and 401K updates.Īlthough there’s no native Mac client, the web interface works extremely well and Personal Capital looks like an application that’s built for macOS. The Investment Checkup Tool is one of the best things about Personal Capital as it immediately identifies areas where you should diversify investments without increasing the risk. This means it gives you a clear overview of your investments and makes recommendations about how you can optimize your finances. Personal Capital is built around 3 simple pillars: Knowing Your Net Worth, Analyzing & Optimizing Investments and Planning For The Future. Personal Capital can also import Microsoft Money files from Windows if they’re in CSV format. It also connects to your bank, credit card, credit union and other financial institutions so that it can automatically download transactions.

#Quicken 2015 for mac vs ibank how to#

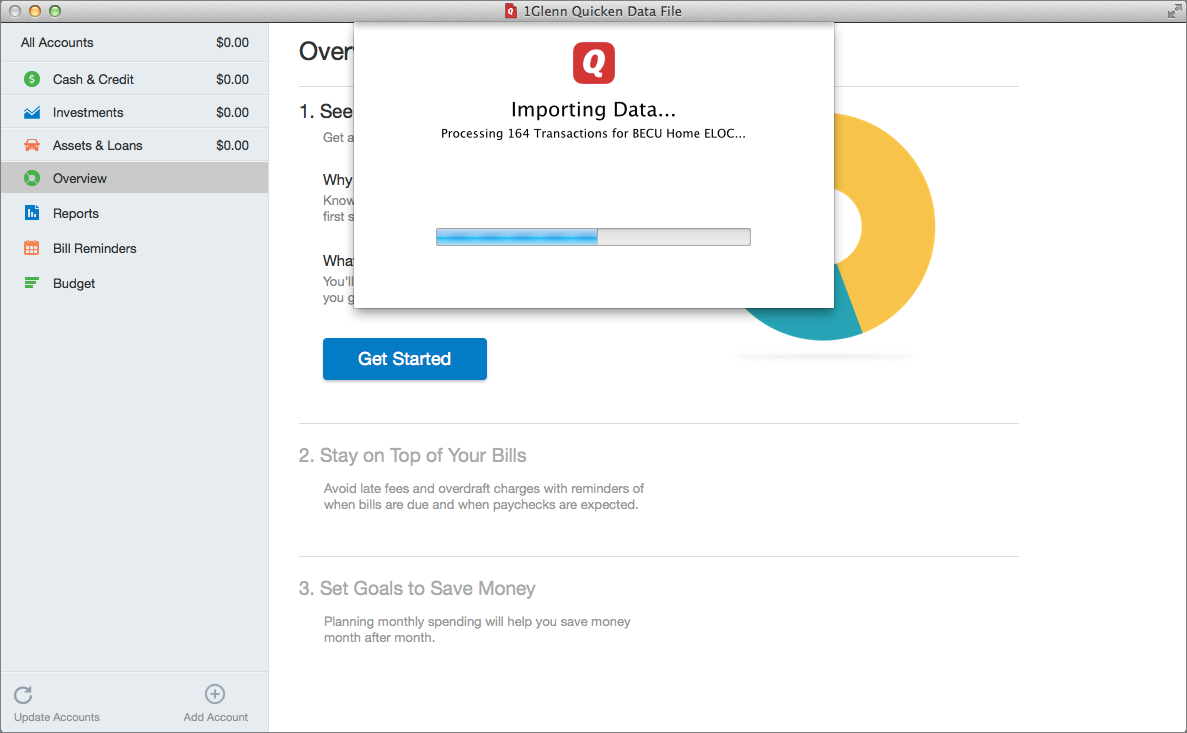

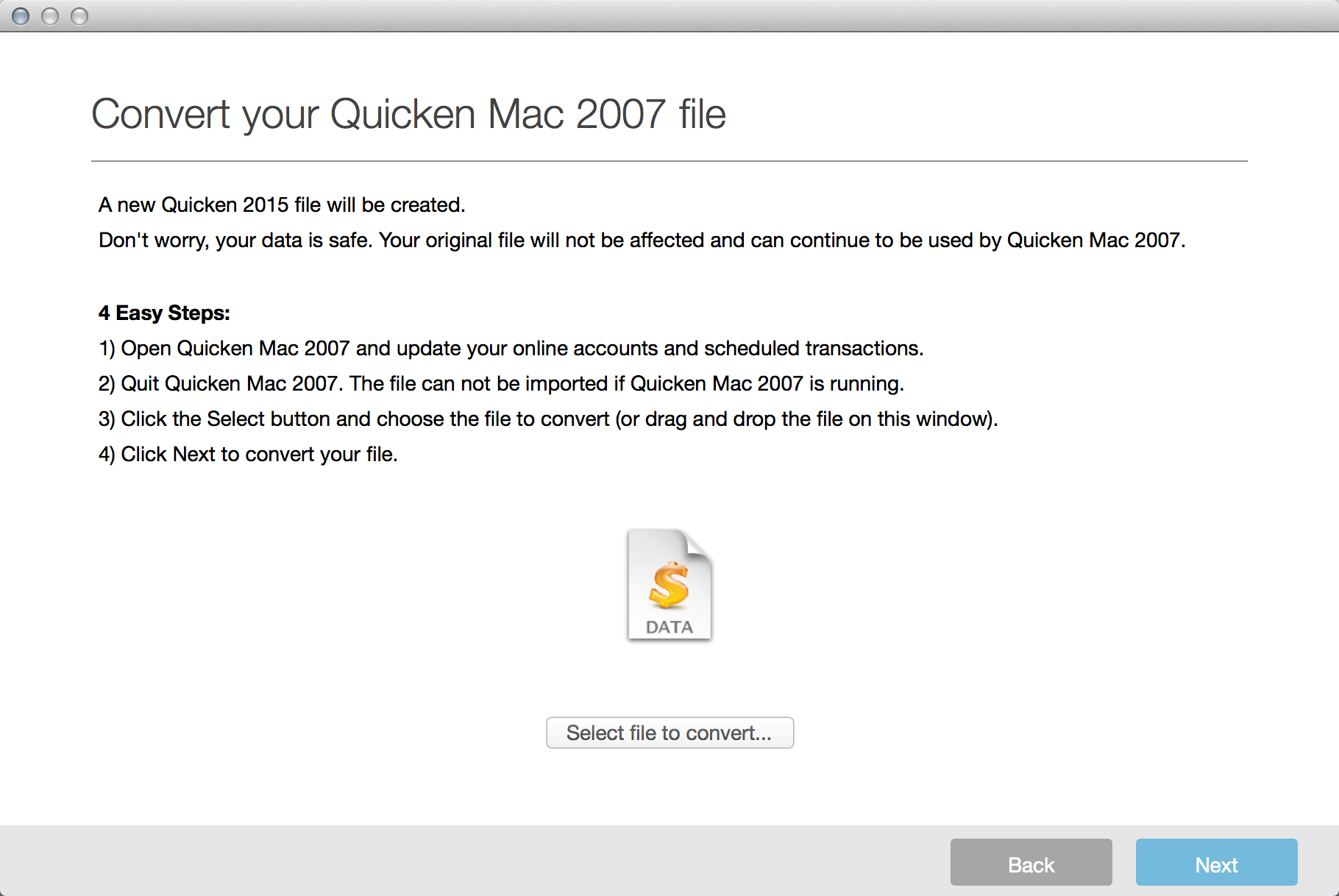

Not only that but Personal Capital is free to use unless you want a personal consultation about how to maximize your investments (which you don’t have to do). It can import your Quicken 2007 and Essentials 2010 files, as well as Windows Quicken files.Personal Capital is more than just a way to manage your money, it actually advises you on how to maximize your capital and investments. There’s no free trial, but Intuit offers a 60-day money back guarantee (at least if you buy it from Intuit, not sure about the Mac App Store). It’s a substantial rewrite for modern Macs and offers mobile device integration. Undoubtedly there will soon be reviews, but if you’re a Quicken fan, you’ll probably want to check it out.

#Quicken 2015 for mac vs ibank software#

It’s the first software I’ve seen released with a “ vote for your favorite new feature” list in lieu of those features actually being included notably online bill pay is missing, and there is no mention of whether you’ll be able to send your backup file to your accountant who uses the Windows version. Is it any good? I’m skeptical but hopeful. Which is why I was surprised to read that there is now Quicken 2015 for Mac, which Intuit released today. Or some kept using Quicken 2007 for Mac, despite it taking nine months for Intuit to retrofit it to run on OS X 10.7 and later. So users either used Quicken for Windows in Parallels Desktop, or quit Quicken in favor of iBank or even easier-to-use online services like Mint (which I’m a fan of, despite it now being owned by Intuit). While Intuit did release Quicken Essentials 2010 for Mac, it had a very stripped down feature set, and everyone hated it. Still, it was Quicken, the name brand of personal finance software.

It’s long been a second-class citizen compared with its Windows versions, with longstanding complaints of bugs, slow updates, poor support, and file format incompatibilities.

Frankly, I thought Quicken for Mac had been abandoned by Intuit.

0 kommentar(er)

0 kommentar(er)